How HSA Health Plans Work

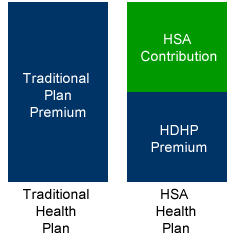

HSA Health Insurance > How HSA Health Plans WorkThe two components of an HSA health plan.

With health care costs rapidly increasing year after year, many people responsible for buying their own health insurance find that traditional plans with lower deductibles and high premiums are impractical. The wise choice is an HSA health plan, which protects against large medical bills, provides tax advantages and keeps premiums affordable.

An HSA health plan consists of two components, a federally qualified High Deductible Health Plan (HDHP) and a tax sheltered Health Savings Account (HSA). It's the ideal way to protect yourself from large medical bills that could bankrupt a individual while providing the advantages of paying your medical expenses with tax free HSA dollars! With traditional health plans becoming more expensive the smart way to protect yourself is with an HSA health plan.

What is a High Deductible Health Plan (HDHP)?

You must have coverage under a HSA qualified "high deductible health plan" to open and contribute to an HSA. For 2013 the Department of the Treasury stipulates that a HDHP must have a minimum deductible of $1,250 for self-only coverage and $2,500 for family coverage. In addition, annual out-of-pocket expenses (including deductibles, co-pays, and co-insurance) cannot exceed $6,250 for those with self-only coverage and $12,500 for families.

In general, the deductible must apply to all medical expenses (including prescriptions) covered by the plan. However, plans do pay for "preventive care" services without the deductible applying. Preventive care can include well-child care, child and adult immunizations, annual physicals, mammograms. pap smears, etc.

What is a Health Savings Account (HSA)?

A Health Savings Account is a pretax fund that you can use to pay for qualified medical expenses, including bills that go towards meeting your health plan deductible and many other qualified medical expenses. The money you put into your HSA is tax deductible, it earns interest and grows tax deferred, and funds can be withdrawn tax free when used to pay for qualified medical expenses. For a detailed description of Health Savings Accounts see IRS Publication 969.

An HSA is established with a bank or credit union of your choice, you control all the decisions about the account including how much to fund it, which medical bills to pay and whether to invest any of the money in your account.

HSA Contribution Limits

The amount you contribute to your HSA is subject to annual contribution limits. The amounts differ depending on the number of family members covered by your HDHP. If your health plan covers only one family member (such as yourself), then you are limited to the individual contribution limit. If your HDHP covers two or more family members then you can contribute up to the family maximum contribution limit.

The 2012 HSA contribution limits:

- HDHP members with Self-Only coverage - $3,100.

- HDHP members with Family coverage (two or more) - $6,250.

The 2013 HSA contribution limits:

- HDHP members with Self-Only coverage - $3,250.

- HDHP members with Family coverage (two or more) - $6,450.

"Catch-up" contributions by individuals who are age 55 or older is $1,000.

Medical Expenses payable with HSA Funds

Following is a partial list of medical expenses you can pay with your pre-tax HSA dollars. For a complete list see IRS Publication 502. It is important to note that some of these services may not be covered by your High Deductible Health Plan, but your still eligible to use your tax free HSA dollars to pay for these services.

New Healthcare regulations effective January 1, 2011 limit the use of HSA funds to pay for over the counter (OTC) medical supplies. OTC medicines such as aspirin and cold medicines are not eligible expenses without a prescription from a physician. OTC medical supplies such as bandages and diagnostic testing devices (HPB monitor, blood sugar test kits, etc.) are still eligible medical expenses. For additional information on OTC medicines view this IRS article.

Here is a list of some items that you can pay with funds from your HSA.

• Hearing aids

• Hospital services

• Laboratory fees

• Long Term Care Insurance

• Prescription medications

• Nursing home fees

• Orthodontia (braces)

• Smoking cessation

• Special education

• Sterilization

• Transplant expenses

• Vision correction (lasik)

• Weight loss program

• Wheelchair

• Ambulance services

• Birth Control Pills

• Chiropractic treatment

• Contact lenses

• Dental treatment

• Eye glasses

• Fertility enhancement

Medical Expenses NOT payable with HSA Funds

Here is a list of some items that you cannot pay with funds from your HSA.

• Hair transplants

• Health club dues

• Household help

• Maternity clothes

• Rx from outside U.S.

• Nutritional supplements

• OTC meds w/out prescription

• Swim or dance lessons

• Teeth whitening

• Veterinary fees

• Childcare

• Cosmetic surgery

• Diaper service

• Electrolysis

• Funeral expenses

Penalties for withdrawing funds for non-qualified expenses?

Effective Jan 1, 2011 the penalty for withdrawals made for non qualified medical expenses increases from 10% to 20%. After you turn 65, the additional tax penalty no longer applies. If you become disabled and/or enroll in Medicare, the account can be used for any purpose without paying the additional penalty.

Who's medical expenses can be paid from my HSA?

You can use the money in your account to pay for qualified medical expenses of yourself, your spouse or your dependent children. You can pay for expenses of your spouse and dependent children even if they are not covered by your HDHP.

What happens if I cancel my HDHP?

If you were to cancel your HDHP, or become insured with a health plan that is not HSA qualified then you may no longer make contributions to your HSA. Your annual contribution for the year you became ineligible will be limited pro rata - depending on the number of months you were covered by an HSA qualified health plan. Any remaining funds that you have in your account will remain and you can spend the balance on any HSA qualified medical expense until the account balance is zero.

What happens to my HSA when I retire?

As soon as you are covered by Medicare you may no longer fund your HSA. You can still use your tax free HSA funds to pay for qualified medical expenses - including your co-pays, deductibles and coinsurance that is not covered by Medicare.

Once you turn 65 you may also use your HSA funds as income - without any penalties, just like an IRA, but you would then be taxed on these non qualified distributions at your current tax rate.

What happens to my HSA when I die?

If your spouse becomes the owner of the account, your spouse can then use it as if it were their own HSA. If you were not married the account will no longer be treated as an HSA upon your death. The account will pass to your beneficiary or become part of your estate (and be subject to any applicable taxes).

Will I ever lose my HSA deposits?

No. Money deposited into your HSA rolls over from year to year. You can contribute money every year into your HSA up to your annual maximum and the funds will roll over each year, just like an IRA.

Some people confuse an HSA with another tax free program called a Flexible Spending Account (FSA). With a FSA you will lose your contributions if they aren't spent within the FSA plan year, known as the "use it or lose it" rule.